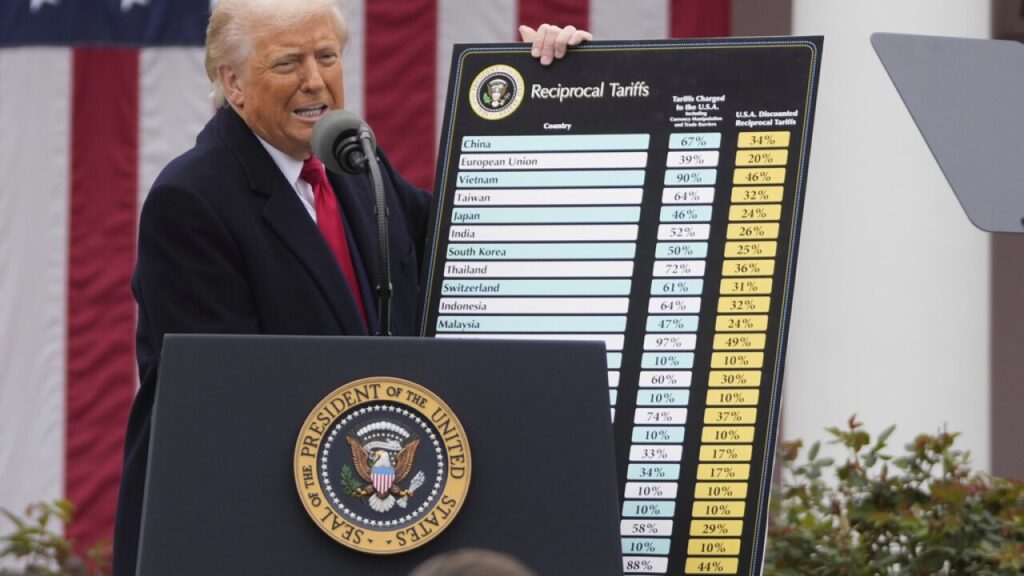

In a bold and controversial move, the United States has announced US 30% tariffs on imports from the European Union and Mexico. This decision, declared by President Donald Trump, will take effect from August 1, 2025, and has already sent shockwaves through global financial markets.

The US 30% tariffs are part of the government’s broader “America First” policy, which aims to protect domestic industries from foreign competition. However, this aggressive step is raising serious concerns among economists, global investors, and trade partners alike.

Why Global Markets Are Nervous

Soon after the US 30% tariffs were announced, stock markets around the world began to react. European markets dropped nearly 2%, while US markets also saw red flags. Investors are worried that this could trigger a new round of trade wars, destabilizing the already fragile global economy.

The European Union didn’t take this lightly. EU officials quickly criticized the move, calling it unfair and harmful to international cooperation. In response, they’ve hinted at imposing €21 billion in retaliatory tariffs against US goods. Mexico also expressed strong disapproval, warning that this decision will seriously affect bilateral trade relations.

What Is the US Government Trying to Achieve?

According to the Trump administration, the US 30% tariffs are designed to level the playing field for American companies. They argue that unfair trade deals over the years have hurt the US economy and caused significant job losses. These new tariffs, they say, are a necessary step to restore balance and rebuild domestic industries.

But critics argue this strategy could backfire. While some local industries may get short-term protection, the long-term impact could be damaging if other nations retaliate with similar trade barriers.

Impact on the Global Economy

The introduction of US 30% tariffs could have far-reaching effects. Prices of imported goods may rise, hurting consumers and businesses alike. Industries like automobiles, electronics, agriculture, and raw materials are expected to be hit the hardest.

There is also growing fear that these tensions may lead to a global economic slowdown, especially if other major economies get involved. Developing countries that trade heavily with both the US and EU could face the worst consequences.

What Happens Next?

Right now, the world is watching closely. Will the EU and Mexico retaliate? Will diplomatic negotiations bring relief, or is this just the beginning of a larger trade war?

One thing is certain—the US 30% tariffs have shaken the global economy and opened a new chapter in international trade politics. It’s a high-stakes move that could reshape global alliances, disrupt supply chains, and redefine the rules of global commerce.

Related Post:

Elon Musk Donald Trump feud : From Power Partners to Public Enemies in 2025

Share this:

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to email a link to a friend (Opens in new window) Email

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on Threads (Opens in new window) Threads

- Click to share on WhatsApp (Opens in new window) WhatsApp